Industry

How Blockchain is Transforming the IT Industry: It Could Make or Break Your Business

Introduction what is Blockchain technology? Blockchain technology is transforming industries globally. It is a digital, decentralized ledger that

Introduction what is Blockchain technology? Blockchain technology is transforming industries globally. It is a digital, decentralized ledger that

Introduction More than a venue for vanishing communications and strange filters, Snapchat is the focus of Snap Inc.,

What is the Asian Infrastructure Investment Bank? Definition and Purpose of AIIB The AIIB is a multilateral bank

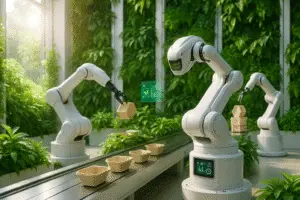

In today’s rapidly advancing technological world, industrial automation robotics has emerged as a game changer for industries worldwide.