Argenta Portfolio Dynamic R Dis: Your Complete Investment Guide

Investing wisely is crucial in today’s volatile financial markets. One investment solution that stands out for its balanced yet growth-focused approach is the Argenta Portfolio Dynamic R Dis. This article will explain what it is, how it works, its benefits, risks, and suitability, giving you a clear understanding to make informed investment decisions. Understanding Argenta Portfolio Dynamic R Dis The Argenta Portfolio Dynamic R Dis is a retail investment fund designed for individuals who seek long-term capital growth while earning regular income distributions. The “Dynamic” label reflects its strategy to invest heavily in equity markets, while “R Dis” indicates it is a retail class with distribution, meaning it pays out the income generated rather than reinvesting it automatically. Key Features of Argenta Portfolio Dynamic R Dis Here are the defining features that make this portfolio unique: Investment Strategy Explained The Argenta Dynamic Portfolio aims to maximise growth while managing market risks. Its core strategy includes: This diversified approach helps in capturing upside potential while cushioning against market volatility. Benefits of Investing in Argenta Portfolio Dynamic R Dis Investing in this portfolio offers several advantages: Risks to Consider Like all investments, the Argenta Portfolio Dynamic R Dis carries certain risks: Understanding these risks is essential before committing your money. Who Should Consider This Portfolio? The Argenta Portfolio Dynamic R Dis is suitable for: If you prefer stable returns with minimal volatility, a conservative or balanced portfolio might be a better choice. Performance Overview Historically, the Argenta Portfolio Dynamic R Dis has delivered strong returns during market upswings due to its equity-heavy strategy. However, it may also experience sharper declines during market corrections compared to balanced or conservative portfolios. Always check the latest performance reports before investing. Costs and Fees Investing in this portfolio involves certain costs: These fees can impact net returns, so it is important to review the Key Investor Information Document (KIID) or prospectus for detailed cost breakdowns. How to Invest in Argenta Portfolio Dynamic R Dis To invest in this portfolio: Final Thoughts The Argenta Portfolio Dynamic R Dis is a robust option for investors seeking capital growth with regular income payouts. Its diversified yet equity-focused approach makes it ideal for those with medium to high-risk tolerance aiming to grow their wealth over the long term. Always align your investment choices with your financial goals and risk appetite to build a resilient portfolio for the future. Sources ( Argenta Official Website )

Exness App: The Ultimate Guide for Traders in 2025

Introduction In today’s fast-paced trading world, mobile trading apps have transformed how traders invest, analyse, and manage their trades on the go. Among these, the Exness app has emerged as a powerful, trusted, and user-friendly platform for both beginners and professional traders. This comprehensive guide will walk you through everything about the Exness app – its features, advantages, setup process, and why it stands out in the competitive forex and CFD trading industry. 1. What is Exness? Exness is a globally recognised Forex and CFD broker founded in 2008. It offers trading services across multiple assets, including forex pairs, metals, cryptocurrencies, energies, stocks, and indices. Regulated by reputable authorities like CySEC and FCA, Exness has earned a reputation for transparency, fast withdrawals, and excellent client support. 2. Introducing the Exness App The Exness app is the broker’s official mobile trading platform designed for Android and iOS devices. It allows traders to access their accounts, analyse markets, place trades, and manage funds conveniently from anywhere in the world. Key highlights of the Exness app include: 3. How to Download the Exness App Downloading the app is simple and takes just a few minutes: Alternatively, you can directly download it from the official Exness website to ensure authenticity. 4. Setting Up Your Exness Account on the App After downloading: Once your account is verified, you can start trading immediately. 5. Features of the Exness App Here are some standout features that make the Exness app popular: A. Real-Time Market Data Get live quotes on all tradable instruments with minimal latency, ensuring you never miss market moves. B. Seamless Fund Management Deposit and withdraw funds instantly using bank transfers, e-wallets, crypto, or cards. C. Advanced Charting Tools Analyse market trends with interactive charts, multiple timeframes, technical indicators, and drawing tools. D. In-App Customer Support Contact Exness support directly from the app via live chat, email, or call-back requests. E. Risk Management Features Set stop loss, take profit, and pending orders to manage your trades effectively even when away from your screen. 6. Exness App vs MetaTrader App Many traders wonder whether to use the Exness app or stick to MetaTrader 4 (MT4) / MetaTrader 5 (MT5) apps. Here’s a quick comparison: Feature Exness App MT4/MT5 App Broker Integration Exclusive to Exness accounts Multiple brokers supported User Interface Simple and intuitive Slightly complex for beginners Trading Options Forex, metals, indices, crypto Forex, metals, indices, crypto Fund Management Direct deposits and withdrawals Needs broker portal for funding Verdict: The Exness app is perfect for traders looking for a one-stop solution for trading and fund management within the same interface. 7. Advantages of Using the Exness App These benefits make Exness a trusted choice for mobile traders globally. 8. Limitations of the Exness App 9. Tips to Trade Effectively on the Exness App Here are practical tips to maximise your trading potential: 10. Is the Exness App Safe? Security is a top priority for Exness. The app uses SSL encryption, two-factor authentication (2FA), and strict verification protocols to protect user funds and data. Being regulated by top-tier authorities adds to its trustworthiness. Conclusion The Exness app is undoubtedly one of the best trading apps for forex and CFD traders in 2025. Its intuitive design, fast execution, easy fund management, and strong security make it ideal for anyone looking to trade professionally or as a side income stream. If you want a reliable, regulated, and user-friendly trading platform, downloading and exploring the Exness app today can be a game-changer in your trading journey.

Industrial Automation Robotics: Revolutionising Manufacturing for the Future

In today’s rapidly advancing technological world, industrial automation robotics has emerged as a game changer for industries worldwide. From automotive assembly lines to food packaging units, robots are transforming the way companies carry out production. In this article, we will explore what industrial automation robotics is, its history, benefits, challenges, applications, and the future it holds for global industries. What is Industrial Automation Robotics? Industrial automation robotics refers to the use of robotic systems and automated machinery to perform tasks traditionally handled by human workers in industrial settings. These robots are designed to carry out repetitive, precise, and sometimes dangerous tasks with high speed, accuracy, and reliability. They’re programmed to operate independently or alongside human workers—ultimately enhancing productivity and safety across manufacturing units. A Brief History of Industrial Robotics t all started in the 1950s: George Devol’s invention of Unimate, the first programmable robot, launched the industrial robotics revolution By the 1960s, General Motors adopted Unimate for their assembly lines, marking the beginning of robotic automation in manufacturing. Over the decades, with advancements in microprocessors, AI, and sensor technologies, industrial robots have evolved into highly sophisticated machines capable of learning, adapting, and working collaboratively with humans. Types of Industrial Automation Robots There are various types of industrial robots, each designed for specific tasks: 1. Articulated Robots: These are the most common robots with rotary joints, widely used for welding, painting, and assembly. 2. SCARA Robots: Engineered for efficiency, SCARA robots dominate pick-and-place automation—leveraging unmatched speed, flexibility, and repeatability (<0.1mm precision) 3. Cartesian Robots: Commonly called gantry robots, these systems leverage three-axis linear motion (X, Y, Z)—enabling high-accuracy workflows in CNC machinery and large-scale 3D printing. 4. Delta Robots: Lightweight robots used for high-speed picking and packaging applications. 5. Collaborative Robots (Cobots): Cobots are designed to work safely alongside humans, assisting in assembly, packaging, and quality inspection tasks. Key Benefits of Industrial Automation Robotics Industrial automation robotics offers several benefits to industries across sectors: Applications of Industrial Automation Robotics Today, industrial robots actively transform manufacturing processes including: 1. Welding Consequently, robotic welding achieves reliable weld quality and safety gains—most notably in auto production, where precision impacts margins. 2. Assembly Robots assemble complex components swiftly and accurately, improving product standards. 3. Material Handling From packaging to palletising, robots manage heavy materials efficiently. 4. Painting Robots provide uniform painting with minimal wastage, crucial in automobile and furniture manufacturing. 5. Quality Inspection Robotic vision systems detect defects that are often missed by human eyes, ensuring high-quality output. Impact on Workforce and Job Opportunities A common misconception is that robotics eliminates jobs. In practice, automation robotics drives job transformation—specifically opening high-value opportunities for upskilled professionals. Industries now require robotics engineers, programmers, maintenance technicians, AI experts, and system integrators to design, operate, and manage robotic systems. Upskilling and reskilling programs are essential to prepare the workforce for this technological shift. Challenges in Implementing Industrial Automation Robotics Despite the advantages, industries encounter several hurdles in the adoption of robotics. Future Trends in Industrial Automation Robotics The future of industrial robotics is promising with emerging trends such as: 1. AI and Machine Learning Integration Robots will become smarter with AI, enabling them to make real-time decisions and adapt to changing environments. 2. IoT Connectivity Internet of Things (IoT) will connect robots with production systems for seamless data exchange and remote monitoring. 3. Human-Robot Collaboration Cobots will continue to evolve, making collaboration safer and more efficient in complex tasks. 4. 5G Technology With ultra-fast 5G networks, robots will communicate faster, enhancing automation in real-time applications. 5. Sustainable Robotics Future robots will focus on energy efficiency and environmentally friendly operations, contributing to green manufacturing goals. Top Companies Leading Industrial Automation Robotics Some of the leading global companies in the robotics industry are: How Small Businesses Can Adopt Industrial Automation Robotics Previously, robotics was limited to large industries; however, small and medium enterprises (SMEs) can now integrate automation to remain competitive. Moreover, affordable cobots and modular robotics systems are making automation more accessible. In addition, leasing options, government subsidies, and robotics-as-a-service models further ease adoption costs. As a result, small businesses are increasingly empowered to automate packaging, inspection, and assembly tasks effectively. Conclusion In conclusion, industrial automation robotics is transforming manufacturing by boosting productivity, enhancing safety, and improving product quality. Although it poses challenges—such as high initial costs and skill shortages—the benefits significantly outweigh the drawbacks. With the rapid advancement of technologies like AI, IoT, and smart sensors, robotics is set to play an even more pivotal role in shaping the future of global industries. Therefore, for businesses striving to stay competitive, investing in industrial automation robotics is no longer optional—it is essential for long-term growth, sustainability, and global success.

Retirement Planning for Self Employed: Your Comprehensive Guide to Financial Freedom

Table of Contents 1. Why Solo Retirement Planning Feels Different (But Doesn’t Have To) Let’s be real: when you’re self-employed, retirement planning can feel like assembling IKEA furniture without instructions. No HR department handing you a shiny 401(k)? No matching contributions magically appearing? Just you, your hustle, and that nagging voice asking, “Am I saving enough?” Here’s the good news: you have superpowers traditional employees don’t. You can choose retirement accounts with higher limits, better tax breaks, and ultimate flexibility. This guide is your blueprint to building a retirement as unique as your business. 2. The Naked Truth: Why Flying Solo Makes Retirement Planning Non-Negotiable Picture this: Your freelance graphic designer friend Sarah thought she’d “work forever.” Then tendonitis hit at 58. Scary? Absolutely. Here’s why planning isn’t optional when you’re your own boss: 💡 Truth bomb: The best time to plant a retirement tree was 10 years ago. The second-best time? Today. 3. Your Secret Weapons: 4 Retirement Accounts Built for Solo Warriors 🚀 The Supercharged Solo 401(k) Perfect for: Solopreneurs with no employees (except maybe your cat). ⏱️ The Set-It-and-Forget-It SEP IRA Perfect for: Consultants, Uber drivers, or anyone with unpredictable income. 🔥 The Tax-Slaying Roth IRA Perfect for: Side-hustlers or those betting on higher taxes later. 🏦 The “Think Big” Defined Benefit Plan Perfect for: High-earners (think $200K+) ready to save aggressively. 4. Choosing Your Financial Sidekick: Which Account Fits Your Hustle? Ask yourself: ✨ Pro move: Mix & match! Pair a SEP IRA with a Roth IRA for tax diversification. 5. Your 5-Step Game Plan: From “Where Do I Start?” to “I’ve Got This!” 6. Freedom Awaits: Your Invitation to Future You Being self-employed means you’ve bet on yourself. Retirement planning? It’s just extending that bet. The magic isn’t in perfection—it’s in starting. Open one account this week. Fund it with $100. Celebrate that win. 🌟 Your future is a business only you can build.Start construction today.

Top 5 Essential Books to Learn Investing Basics: Start Your Wealth Journey Right

Why Learn Investing Basics from Books? In an age of TikTok tips and AI stock picks, books remain the most reliable way to build foundational knowledge. These essential books to learn investing offer structured, time-tested wisdom free from hype or algorithms. For true beginners, these 5 essential books cut through the noise, teaching principles that work in bull markets, bear markets, and everything in between. The 5 Essential Books to Master Investing Basics 1. The Little Book of Common Sense Investing By John C. Bogle Why it’s essential: Bogle—founder of Vanguard—reduces investing to its simplest, most powerful form: low-cost index funds. This book teaches why “owning the entire market” beats stock-picking for 99% of investors in their quest to learn investing through essential books. 2. A Random Walk Down Wall Street By Burton G. Malkiel Why it’s essential: Malkiel’s classic explains market efficiency and why “beating the market” is nearly impossible long-term. It covers stocks, bonds, real estate, and behavioral pitfalls in plain language, proving why these books are essential for learning investing. 3. The Psychology of Money By Morgan Housel Why it’s essential: Money success isn’t about IQ—it’s about behavior. Exploring these themes through diverse stories, Housel’s book stands as an essential read for learning investing. His storytelling approach reveals why patience, humility, and embracing uncertainty matter more than complex strategies. 4. The Intelligent Investor (Revised Edition) By Benjamin Graham, Commentary by Jason Zweig Why it’s essential: The bible of value investing, updated for modern readers. Graham’s “margin of safety” principle teaches how to invest without taking reckless risks. Zweig’s commentary makes it beginner-friendly for those picking their essential books to learn investing. 5. The Little Book That Still Beats the Market By Joel Greenblatt Why it’s essential: Greenblatt delivers a shockingly simple stock-picking formula (“The Magic Formula”) in under 200 pages. Ideal for beginners curious about picking individual stocks systematically and looking for essential books to learn investing. Why These Books? These weren’t chosen randomly. To be truly essential for learning investing basics, each book: Beyond Books: Quick Tips for Beginners These 5 essential books compress 100+ years of market wisdom into actionable starters. They won’t promise overnight riches—but they will help you build durable wealth, avoid costly mistakes, and invest with unshakeable confidence.

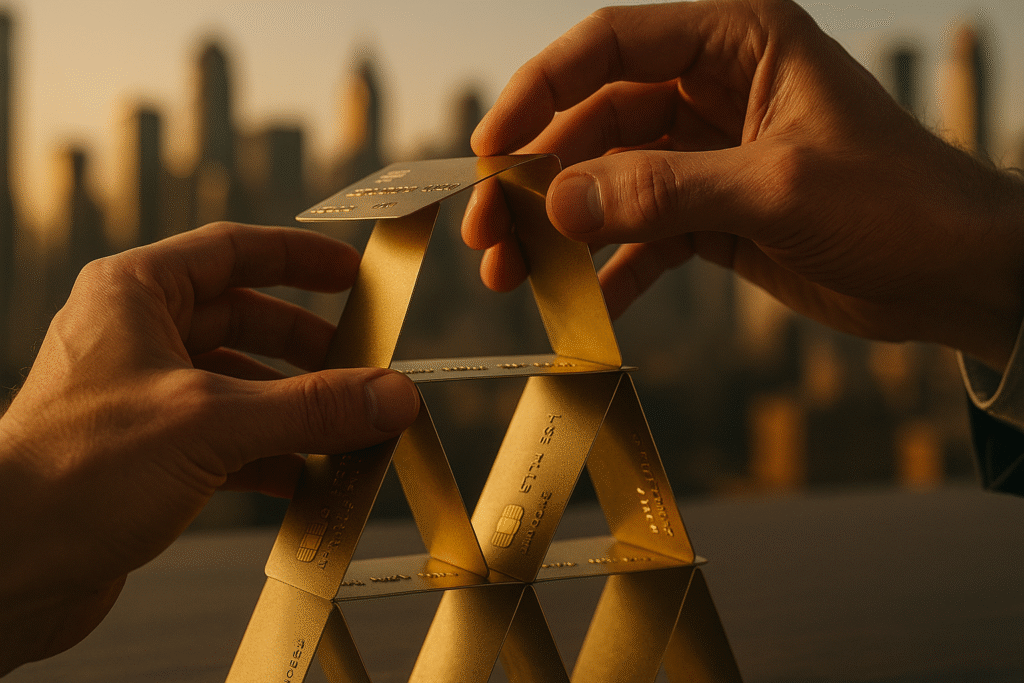

5 Comman Credit Mistakes And How to Avoid Them

Introduction A single missed payment or a maxed-out card could look like a minor glitch, but in the credit world, small errors can leave significant scars—sometimes for years. These errors can make Comman Credit Mistakes and make it difficult to get a loan, rent an apartment, or even pass some employment background checks, not only lower a grade on your credit report. As you can check the report of credit card ownership it is very comman to have now a days and risk factor is also very comman in credit cards. This blog will highlight five typical credit blunders that may subtly ruin your financial future. More importantly, starting today you will learn practical, simple-to-follow techniques to avoid them so you may safeguard and even raise your credit score. Mistake 1: Missing Payments — The Big One Why Late Payments / Missing Payments damaging? Payment history is the most important factor affecting your credit score. Actually, it usually accounts for around 35% of your FICO and VantageScore the only biggest component in most credit rating models. That means if you already have a good credit score, even one late payment can cause a significant decline. Late payments are a red flag for lenders since they imply you could have trouble fulfilling upcoming commitments. How it haunts you? One missed or late payment—even if it’s only a few days overdue—can stay on your credit report for up to seven years. Though it may still affect lending choices long after, the effect is most pronounced in the first few years. That can cause: How to avoid it! The good news is, preventing missed or late payments is mostly about building consistent habits and automating where possible: tip: Life happens — if you miss a payment, call your lender right away. If you’ve been a reliable customer, some creditors will grant a one-time late fee waiver or agree to remove the late mark from your credit report as a goodwill gesture. Acting quickly can make a big difference. Mistake 2: Maxing Out Your Cards — Even If You Pay Them Off Why it’s damaging? Next to payment history, the second most crucial determinant of your credit score is your credit utilization ratio—that is, the proportion of your total credit you are using. Lenders interpret it as a sign you might be financially stretched if you frequently use most or all of your credit. Paying your balance in full every month won’t keep your score from being negatively affected if at the time your issuer reports to the credit agencies your utilization rate is high. How it haunts you? Maxing out your cards can cause a significant drop in your credit score, especially if it pushes your utilization above 30%. The higher the ratio, the bigger the potential damage. High utilization can: How to avoid it! Keeping your credit utilization low is one of the fastest ways to improve or maintain your score: tip: Think of your credit limit like a speed limit — just because you can hit the maximum doesn’t mean you should. Keeping your usage well below the limit shows lenders you can handle credit responsibly. Mistake 3: Ignoring Your Credit Reports — Flying Blind Why it’s damaging? Lenders, landlords, and sometimes even employers assess your trustworthiness using your credit report, which is like your financial résumé. You won’t notice flaws, old information, or fake accounts that might be lowering your score if you never check it. Regrettably, if you’re not careful, identity theft might go unreported for months or even years and mistakes on credit records are more prevalent than most people would think. How it haunts you? Inaccurate negatives — such as a wrongly reported late payment, an account that doesn’t belong to you, or a debt that’s already been paid off — can remain on your report for up to seven years. That can: How to avoid it! Staying on top of your credit report is simpler than it sounds: tip: Think of reviewing your credit report as doing a quick health check — it’s much easier to fix a small issue now than to deal with a full-blown financial emergency later. Mistake 4: Closing Old Credit Cards — A Silent Score Killer Why it’s damaging? Closing an outdated credit card you never use could appear harmless—perhaps even wise. However, doing so could shorten your credit record and lower your overall credit limit, which would lower your score. Models for credit scoring reward a longer credit history since it demonstrates to lenders that you have handled credit across time. Closing an outdated account removes some of your track record. How it haunts you? Closing an old card can impact your credit score in two ways: This means your score can drop even if the card had a zero balance and you never missed a payment. The effect can last for years, especially if you have a thin credit file. How to avoid it! tip: Think of your oldest credit account as the “senior member” of your financial family — it’s earned its place, and keeping it around strengthens your household’s reputation in the eyes of lenders. Mistake 5: Applying for Too Much Credit at Once — The Hard Inquiry Pile-Up Why it’s damaging? Each time you ask for a fresh credit card, loan, or line of credit, the lender conducts a hard inquiry on your credit record. One tough question might only slightly lower your score, but repeated ones in a brief time add up. A group of applications gives lenders the impression that you are abruptly in desperate need of a lot of credit, which might indicate financial difficulty. How it haunts you? Too many new applications in a short timeframe can: Even if you get approved, juggling multiple new accounts can increase the risk of missing payments and raise your utilization ratio. How to avoid it! tip: Think of applying for credit like planting seeds — if you throw them all into the ground at once, they

Beyond the Hype: Your Step-by-Step Framework for Analyzing Thematic ETFs (Before You Invest)

Introduction The buzz around thematic ETFs easily draws people in. Whether it’s Artificial Intelligence, clean energy, cybersecurity, or even space tourism, these funds promise a chance to invest in “the next big thing.” The problem? Shiny new ETFs don’t always deliver on their promise. Some have great marketing but weak fundamentals. Others might sound innovative but hold companies barely connected to the theme. This guide is for anyone who’s ever felt tempted to buy a thematic ETF after seeing it in the news or trending on social media. We’re going to strip away the hype and walk through a step-by-step framework that helps you separate the marketing fluff from solid investment opportunities. Step 1 – Understand the Theme and Its Investment Thesis Understand exactly what you are investing in before you ever see a ticker symbol.Ask oneself: The theme is what precisely? Is it niche (like quantum computing) or broad (like technology)?Is the tendency here permanent? Seek for long-term influences like technical advances, regulatory backing, or demographic changes. What would throw it off course? Every trend carries possible risks including consumer acceptance delays, government opposition, or competitive disturbance. Example: Government incentives and worries about climate change provide the renewable energy industry great tailwinds. The metaverse fever wave of 2021 lost traction, however, when adoption and monetization fell short of projections. Pro Tip: The majority of ETF issuers provide a whitepaper or fact sheet outlining the rationale behind the investment. Proceed with caution if that document is ambiguous or overloaded with buzzwords. Step 2 – Examine the Underlying Holdings The name of a thematic ETF can be misleading. The name ‘Future Energy ETF’ might suggest it’s packed with solar and wind companies, but a closer look could reveal oil giants or unrelated industrials inside. Here’s what to check: Example: A cybersecurity ETF could include a tech conglomerate that earns just 5% of revenue from security products. That’s not the same as a company whose entire business is cybersecurity. Step 3 – Review the Index Methodology (in Depth) Most thematic ETFs track a particular index; they do not just pick stocks at random. This index serves as a rule book determining: Understanding this underlying mechanism is essential since even two ETFs with the same subject can totally affect the behavior of the ETF. Why It Matters Although two ETFs could both be called Clean Energy, one could include tiny, high-growth solar companies while the other could be dominated by big-cap utility companies. Usually, the index method is the cause of that disparity. Main Things to Investigate 1. Inclusion Criteria – How companies qualify for the index Tip: Expect more theme dilution holdings that are only marginally connected to the theme if an index has fairly flexible standards. 2. Weighting Approach – How much each stock contributes For instance, a market-cap weighted artificial intelligence ETF could have 30% of its investments in one mega-cap tech company, but an equal-weight version would distribute that exposure over dozens of lesser firms. 3. Rebalancing Frequency– how frequently the index is revised If a topic like artificial intelligence or cybersecurity insurance company changes rapidly, frequent rebalancing might imply the ETF retains obsolete or less relevant businesses for far too long. Step 4 – Assess Historical Performance (Cautiously) All of us have heard it: Past success does not ensure future outcomes. Its still worthwhile to look at though to see how the ETF reacts in various market situations rather than to forecast future returns. Questions to ask: Comparing against a benchmark (like the S&P 500) can help you see if youre truly getting theme-driven performance or just expensive index-like returns. Step 5 – Analyze Costs and Liquidity Even if a thematic ETF has strong holdings, costs can quietly eat away at your returns. Liquidity matters. Thinly traded ETFs can be expensive to enter and exit. Step 6 – Identify Key Risks Every theme has its vulnerabilities: Understanding these risks upfront lets you size your position appropriately. Step 7 – Make Sure It Fits Your Portfolio Thematic ETFs are like seasoning for a meal—they can add a lot of flavor, but you wouldn’t make the whole dish out of chili powder. They’re usually meant to be satellite holdings—extras that sit around your main, diversified investments—not the foundation itself. Before you hit “buy,” take a minute to ask yourself: Quick example:Say you’ve got 50% S&P 500, 30% international stocks, 15% bonds, and 5% thematic ETFs. Adding a clean energy ETF might make sense if you have zero exposure to that sector. But if your existing funds already hold a bunch of clean energy companies, you’re just making the same bet bigger. Pro tip:Use a portfolio overlap tool (many brokerages have them) to check how much of the ETF’s holdings you already own. You might be surprised—some “specialty” ETFs still hold big names like Apple or Microsoft, just with a fancier label. From Hype to Informed Decision Thematic ETFs can be exciting, inspiring, and — when chosen wisely — profitable. But they’re not lottery tickets. The difference between hype-driven investing and smart investing is research. Now its your time to shine make sure you follow these step wisly. my eyes are waiting to see you success By following this 7-step framework, you’ll know how to: Investing in themes isn’t about chasing headlines — it’s about capturing the trends that will shape our future, while protecting yourself from the noise.

Navigating India’s Income Tax Slabs 2024-25: Old vs. New Regime – Which Path Saves You More?

Choosing how to calculate your income tax in India isn’t just about the numbers on your payslip – it’s a strategic decision impacting your take-home pay and long-term wealth. With two distinct regimes (Old and New) offering different benefits, understanding the latest income tax slabs for FY 2024-25 (AY 2025-26) is crucial. Forget generic advice; let’s break down the facts, figures, and smart strategies to help you decide. The Foundation: Latest Income Tax Slabs (FY 2024-25) 1. The New Tax Regime (Default for Salaried from FY 2023-24): Offers lower headline rates but very few deductions/exemptions (Standard Deduction of ₹50,000 is allowed). This regime is generally simpler. Total Income (₹) Tax Rate Tax Payable (Example Calculation) Up to ₹3,00,000 0% ₹0 ₹3,00,001 – ₹6,00,000 5% 5% on income above ₹3 Lakh (e.g., ₹5L income: 5% of ₹2L = ₹10,000) ₹6,00,001 – ₹9,00,000 10% ₹15,000 + 10% on income above ₹6 Lakh ₹9,00,001 – ₹12,00,000 15% ₹45,000 + 15% on income above ₹9 Lakh ₹12,00,001 – ₹15,00,000 20% ₹90,000 + 20% on income above ₹12 Lakh Above ₹15,00,000 30% ₹1,50,000 + 30% on income above ₹15 Lakh 2. The Old Tax Regime: Offers numerous deductions & exemptions (HRA, LTA, 80C, 80D, Home Loan Interest, etc.) but higher base rates. Total Income (₹) Tax Rate Tax Payable (Example Calculation) Up to ₹2,50,000 0% ₹0 ₹2,50,001 – ₹5,00,000 5% 5% on income above ₹2.5 Lakh ₹5,00,001 – ₹10,00,000 20% ₹12,500 + 20% on income above ₹5 Lakh Above ₹10,00,000 30% ₹1,12,500 + 30% on income above ₹10 Lakh Key Changes & Latest Facts (FY 2024-25): Old vs. New: Which Regime Should YOU Choose? (Beyond the Slabs) The answer isn’t in the slabs alone; it’s in your financial profile. Use this framework: The Critical Calculation: Don’t Guess! Never assume one regime is better. Calculate your tax liability under both scenarios every year: Tools: Use the official Income Tax Department calculator (https://incometaxindia.gov.in/pages/tools/income-tax-calculator.aspx) or reliable financial websites. Action Plan: Making Your Tax Decision The Bottom Line: India’s dual tax regime offers flexibility but demands informed choices. While the New Regime’s slabs and ₹7.5 lakh threshold provide simplicity and relief for many, the Old Regime’s power to drastically reduce taxable income through deductions remains unmatched for strategic taxpayers, especially those with home loans, HRA, or disciplined investments. The latest slabs are your map, but your individual deductions are the compass. Crunch your numbers, understand the latest rules (like the universal Standard Deduction), and choose the path that leaves more money in your pocket. When in doubt, consult a Chartered Accountant for personalized advice.

Old Tax Regime vs New: 8 Smart Reasons Savvy Indians Still Choose the Old Path

Introduction When India introduced the new tax regime under Section 115BAC, it was touted as a game-changer — a simpler, cleaner tax structure with reduced rates and no exemptions. While many welcomed this change, a surprisingly large number of savvy taxpayers continue to stick with the old tax regime. But why? I know it is quit complicated topic and every person have a doubt like a headache which Tax Regime i have to stick, it’s the same question i heard from lot of people lower class to-higher class. So have a look on this example this will clear your path for further article. A Tale of Two Taxpayers Ravi and Meera, both in their early 30s, work in well-paying corporate jobs in Bengaluru. Every February, like clockwork, they sit down with their tax documents, coffee mugs in hand, and try to answer the same dreaded question: “Old regime or new regime — which one saves us more?” Ravi is all about simplicity. “Flat tax rates, no complications — sounds perfect,” he says, leaning toward the new regime. Meera, on the other hand, swears by her meticulous spreadsheet of deductions — from her EPF contributions to home loan interest, health insurance premiums, and even their daughter’s school fees. She does the math and ends up paying far less tax than Ravi, year after year. The surprising part? They earn almost the same. This isn’t just Ravi and Meera’s story. It’s a real dilemma faced by millions of salaried professionals across India today. While the new tax regime is being marketed as cleaner and simpler, the old tax regime continues to reward smart planning and long-term thinking. So why do financially savvy taxpayers still choose the old regime? Let’s break down the 8 key reasons — and you might just realize it’s not “old,” it’s wise. 1. Maximized Deductions Under Section 80C Under Section 80C, the previous system permits a deduction of up to 1.5 lakh for investments in: If you’re already incurring these costs or expenditures, you automatically qualify for this deduction, which makes the former system seem like a wiser decision. if you don’t know how to make financial planing check out this post to stay head from everyone. 2. Home Loan Interest Benefits (Section 24b) Own a home with a loan? You can claim up to ₹2 lakh in deductions annually on interest repayment under Section 24(b) — but only in the old regime. This is especially advantageous for: 3. HRA Exemption Still Rules Under the previous rules, the House Rent Allowance (HRA) exemption can lower your taxable income considerably if you live in a rented home and work as a salaried employee. For city inhabitants, the new government forbids HRA benefits, which could result in greater tax outgo. 4. Deductions for Health Insurance Premiums (Section 80D) Under Section 80D, one of the main benefits of the former tax system is the capacity to deduct health insurance premiums—something totally unheard-of in the current system. Here’s how it works: Who is Covered? Maximum Deduction Allowed Self, spouse, and dependent children ₹25,000 (if under 60 years of age) Parents (below 60 years) ₹25,000 Parents (above 60 years) ₹50,000 Self + Parents (above 60) Up to ₹75,000 total So if you’re paying premiums for yourself, your family, and your senior citizen parents, you could claim up to ₹75,000 in deductions every year and it doesn’t stop at premiums. Under Section 80D, you can also claim deductions for: Why This Is Important Most taxpayers these days already have health insurance coverage as medical crises become more well-known and health care expenses increase. Under the old system, being financially responsible is rewarded. Conversely, the fresh administration provides no Section 80D deduction, which for families with active insurance plans makes it a more expensive alternative. If you’ve already paid for health insurance—especially for elderly parents—the old system maximizes every rupee. 5. Education Loan Interest (Section 80E) Education is one of the most valuable investments you can make for your future. However, with the rising cost of higher studies in India and abroad, many students and parents rely on Education loans to meet their financial needs. Thankfully, the Income Tax Act of India provides relief through Section 80E, which allows you to claim a deduction on the interest paid on education loans. .Organizing college or supporting your child’s education financially? Under Section 80E, valid for up to eight years, the previous system permits limitless deductions for the interest paid on education loans. The fresh administration ignores this advantage, which makes the previous one more desirable for parents and young professionals. 6. Strategic Investment Culture The old regime promotes a disciplined savings mindset by rewarding investments and long-term planning. This includes: For those focused on long-term wealth creation, the old regime aligns perfectly with smart financial behavior. 7. LTA and Other Allowance Exemptions The old regime lets salaried individuals enjoy exemptions on Leave Travel Allowance (LTA), standard deduction, and conveyance — all of which are removed in the new regime. If your company offers these perks, not claiming them would be like leaving free money on the table. 8. Better for High-Income Earners With Investments If you’re in the higher tax brackets and already: …then you can easily structure your finances to pay less tax under the old regime. The more you optimize deductions, the more the old regime wins. Old vs. New Tax Regime – A Quick Snapshot Target Old Regime New Regime Section 80C Benefits Available Not available Home Loan Interest Deduction Up to ₹2 lakh Not available HRA & LTA Exempt Not available Standard Deduction (₹50,000) Available Available (from FY 2023-24) Lower Tax Rates Slabs higher Slabs lower Ideal For Investors & salaried Minimal-investment individuals Concluding Remarks Although the new tax system benefits young earners, freelancers, and those with few deductions, the old tax system is still a strategic powerhouse for people who deliberately manage their money. The decision depends on what best suits your goals and lifestyle rather than on old vs.

Financial Planning & Analysis Priorities for 2025: Navigating Uncertainty with Agility & Insight

I recall a period when my funds felt truly scattered. I was always managing payments, unsure of my spending, and dealing with uneasy money issues. I realized a shift was needed, promptly.Thus, I paused and dove into money strategies and research. I studied books, watched wise experts, made errors, then slowly used learned tips in my own life. With time, I not only took charge of my money, but I also saw true gains – not only in figures, but also in trust and vision. Now, after months of study and real use, I’ve found that why financial planing is a necessity for any business. Don’t worry i did the task for you – Why 2025 Is a Pivotal Year for Finance Teams? The year 2025 is more than just a date on a wall calendar. It’s quickly turning into a key turning point for firms across the globe—mostly for teams doing financial planning work. The world after the pandemic is still finding its footing, and money trouble from inflation, world fights, tech changes, and rules are moving finance groups to strange places. Firms that used to depend on set budgets and expected patterns now meet the strange: messed up supply lines, fast tech changes, and odd new ways people act as buyers. In this shaky setting, finance heads must do more than just “work the numbers. ” They must become key friends in steering through change. The job of FP&A is not just about keeping costs down and guessing income—it has grown to push firms to be quick and strong. Heads need to act first, not react after. And that’s just why 2025 is such a needed year. As we keep going, CFOs and FP&A experts will be asked to work where plans, tech, and facts meet. This calls for a new way of thinking—one that takes in new stuff, likes working together, and moves into doubt with trust. With the right focus set, FP&A groups can turn doubt into a chance. This is important for FP&A because: 5 Pillars of Financial Planning and Analysis The Role of Agility and Insight in a Volatile Economy If recent times have shown something, it’s that nimbleness isn’t extra but vital. By 2025, being quick plus smart thinking will hold up good money plans. Nimbleness helps firms change fast when new stuff comes up, while smarts help pick wise choices, guiding the firm the right way. But getting nimbleness isn’t just rushing around. It means being careful, using facts, and bending your ways as needed. When the money scene jumps, stuff flips real fast. Guesses that used to take ages now need doing right now. Set plans get old fast. This is just where quick money methods, like always-updated guesses, step in. Smarts, then, means seeing more than just the top layer of facts. It’s like finding the reason deep down in the stats. Money groups must turn big facts into plans that firms can use. They should switch from looking back (what was) to looking ahead (what may be), using guess tools, plans for all sorts of cases, plus key-guess stuff. To sum it up: by 2025, the top money teams will mix bending with deep thought. They’ll use quick smarts to spin around fast and sure when things shift. Real-Time Data and Predictive Analytics 1. The Rise of Continuous Planning Gone are the days when financial planning was an annual ritual. In 2025, continuous planning is the name of the game. It’s all about staying current, staying flexible, and staying ahead of the curve. With markets evolving rapidly, a static financial plan just doesn’t cut it anymore. Organizations now need rolling forecasts that can adapt to changing conditions at any moment—and that’s exactly what continuous planning delivers. “Continuous planning, also known as rolling forecasting or agile planning, is an approach that enables FP&A professionals to stay ahead by continuously updating and revising plans based on real‑time data and market conditions”. Workday’s finance blog defines continuous planning as “a forward‑looking approach … that replaces static, annual plans with an ongoing, real‑time cycle of analysis and adjustment,” emphasizing regular refinement of projections and adaption to shifting priorities 2. Leveraging AI and Machine Learning for Financial Forecasts AI and machine learning are not only popular terms; they are changing how financial planning works. By 2025, smart FP&A groups will use these tools to predict things better, spot trends, and guess what will happen, faster than people can.budgets, and identifies risks. AI in financial planning and analysis can: You’re not required to be a data scientist. Your FP&A staff, however, should be taught how to apply artificial intelligence tools for better insights and speed. 3. Let Data Direct Financial Planning and Analysis Decisions Data-driven financial planning and analysis will characterize 2025. Companies most likely to succeed are those who combine inside and outside knowledge to advance predictions and performance. Among the priorities of FP&A should be: Gartner estimates: By 2025, 75% of finance departments will rely on AI-based analytics If your FP&A process still mostly uses spreadsheets, 2025 is the year to upgrade. 4. Improve Business Partner Abilities Professionals in FP&A are expected to serve as internal consultants in 2025 rather than just financial analysts. Good FP&A consists of: One of the most valuable FP&A trends nowadays is finance-business partnering. 5. Include Sustainability and ESG into FP&A Models ESG reporting is now a standard component of basic financial planning and analysis as there is more emphasis on ethical business practices, laws, and environmental impact. Teams working in FP&A ought to: Understand IFRS Sustainability Reporting Standards: Discover More Future-ready FP&A systems have to find a happy medium between financial and non-financial objectives. 6. Upskill Your FP&A Crew for the Future Your FP&A staff will want fresh skills as artificial intelligence, data tools, and agile techniques become commonplace. For 2025, sought-after FP&A abilities: Cross-functional training will help your FP&A experts to better grasp and support every department. 7. Automate Routine FP&A Activities Wasted time is spent on data entry and spreadsheet formatting. In 2025, FP&A automation is absolutely necessary. Automate: Anaplan, Planful, Oracle Cloud EPM, and Power BI among other tools can help to simplify